Tip Distribution Guide for Restaurants, Hospitality & Service Businesses

Tips are a vital part of employee compensation, but managing them fairly and efficiently is easier said than done. From shift-based tip pools to role-based splits, the right tip distribution system can boost morale, reduce turnover, and keep your business compliant with local labor laws.

This guide breaks down tip distribution methods, common challenges, best practices, and how tip pooling software makes it all easier.

Key takeaways

- Tip distribution methods include tip pooling, tip sharing, and direct tip allocation

- Fair tip distribution boosts employee morale, retention, and service quality.

- Manual tip tracking can lead to errors, disputes, and compliance issues.

- Tip distribution software like eTip improves accuracy, transparency, and efficiency.

The importance of fair tip distribution

Tipping plays a crucial role in employees’ earnings, often supplementing base wages significantly. A well-managed tip distribution system ensures that employees feel valued, fairly compensated, and motivated to provide high-quality service.

However, managers often face challenges when managing tip distribution, like:

- Disputes over fairness

- Payroll complexities

- Complying with labor and tip pooling laws

As cash usage declines and digital payments become the norm, hospitality and service businesses must adapt to new ways of distributing tips effectively.

How does tip distribution work?

Tip distribution refers to the process of allocating gratuities among employees fairly and transparently.

This can involve splitting tips from a communal pool, distributing a portion of tips from one department to another, or tracking and paying out individual tips digitally.

Tip distribution is a three-step process:

- Tip collection: Tips may come from various sources — cash, credit card, or digital tipping platforms.

- Allocation: Based on your business’s policies, tips are divided using a formula or system (for example, hours worked, a points-based system, or percentage split).

- Disbursement: Payouts are issued to staff — either manually or automatically via tip distribution software — and processed through payroll or a separate system.

Common tip distribution methods

There is no one-size-fits-all approach to tip distribution. You should choose a method based on your business model, team structure, and legal requirements.

Pro tip: Be sure to check federal and state tip laws before implementing a tip distribution method.

Here are some of the most common approaches to tip distribution:

Tip pooling

Tip pooling is when all tips collected during a shift are combined and distributed among employees based on predetermined criteria such as hours worked or job role.

Pros:

- Encourages teamwork and a cooperative work environment.

- Reduces tipping disparities caused by customer bias.

Cons:

- High-performing employees may feel their efforts go unrewarded.

- Requires careful oversight to ensure fairness.

Tip sharing

Tip sharing is when a portion of tips received by front-of-house staff (e.g., servers and bartenders) is shared with support roles such as bussers, kitchen staff, and hosts.

Pros:

- Recognizes the contributions of all employees, not just those in guest-facing roles.

- Encourages a fairer distribution of earnings.

Cons:

- Requires detailed tracking to ensure fair distribution.

- Can lead to conflicts if employees feel certain roles are under-compensated.

Direct tip allocation

Direct tip allocation is when employees keep the tips they earn directly from guests.

Pros:

- Simple and transparent with minimal administrative effort.

- Employees directly benefit from their performance.

Cons:

- Earnings can be inconsistent, leading to dissatisfaction among lower-tipped employees.

- May discourage teamwork if employees compete for high-tipping tables.

Hybrid models

Many businesses use a combination of these systems, such as direct allocation for servers but a small portion contributed to tip pooling or sharing.

Hybrid tip distribution example:

- A full-service restaurant may implement direct tipping for servers but require that 20% of their earnings go into a tip pool shared among bussers and kitchen staff.

- This ensures equitable distribution while maintaining performance incentives.

Challenges in managing tip distribution

Tip distribution gets messy fast. From tracking payments across shifts to staying compliant and keeping staff satisfied, even small errors can cause big headaches.

Below, we break down the most common challenges — and why using the right tip distribution system matters.

Tracking and accuracy issues

Manually tracking tips — whether from cash, credit cards, or digital payments — can lead to miscalculations, delayed payouts, and potential disputes.

Without a transparent system, employees may question the accuracy of their earnings. That can erode the trust between employees and management and cause poor service quality.

Employee disputes and perceived inequities

If the tipping system lacks clarity, employees may feel short-changed, leading to dissatisfaction and workplace tension. Transparent policies are crucial to maintaining trust.

Processing tips through payroll

According to the IRS, all employee-received tips exceeding $20 per month must be reported as taxable income. Your business has to report tips accurately and comply with all labor and tip sharing laws to avoid penalties — which is easier said than done.

Declining cash usage

The rise of digital payments has made cash tipping less common. Restaurants must adapt by offering alternative tipping solutions that accommodate credit cards and mobile payment users.

Tip distribution best practices

Ensuring fair and transparent tip distribution in restaurants, hotels, and other service businesses is key to maintaining staff morale and trust. Happy employees boost employee retention and service quality.

Here are some guidelines for establishing a tip distribution process at your business:

1. Establish clear and consistent policies

- Define who qualifies for tip distribution and outline how earnings are split.

- Ensure all employees understand the tipping policy before starting.

- Document tip distribution policies in an employee handbook to prevent misunderstandings.

2. Use a digital tipping solution

- Automate tip tracking to minimize errors and improve efficiency.

- Provide employees with real-time access to their tip earnings.

- Reduce the administrative burden on managers by eliminating manual calculations.

3. Comply with wage and labor regulations

- Stay informed about federal and state tipping laws to ensure compliance.

- Ensure tipped employees still meet minimum wage requirements.

- Implement an auditable system to maintain accurate records in case of IRS audits.

4. Educate and communicate with employees

- Train employees on how the tip distribution system works.

- Provide regular updates on any changes to tipping policies.

- Offer a feedback system where employees can voice concerns or suggest improvements.

How tip distribution software helps

Relying on spreadsheets, paper logs, or verbal handoffs to manage tips is inefficient and risky — especially across busy shifts, multiple departments, or high-turnover teams.

Tip distribution software can simplify all of that.

A digital tipping platform removes the friction from tip management. It brings clarity, consistency, and control to every step of the process.

Here’s what tipping software can do for your business:

- Streamline payment tracking

- Seamlessly processes tips from all sources in one place. No more digging through receipts or reconciling multiple systems at the end of a shift.

- Seamlessly processes tips from all sources in one place. No more digging through receipts or reconciling multiple systems at the end of a shift.

- Automate tip allocation

- Apply your custom tip distribution formula — whether it’s hours worked, percentage splits, points-based systems, or role-based distribution — and let the software do the math. You can even adjust rules per team, shift, or department.

- Apply your custom tip distribution formula — whether it’s hours worked, percentage splits, points-based systems, or role-based distribution — and let the software do the math. You can even adjust rules per team, shift, or department.

- Reduce disputes with real-time transparency

- Employees can see exactly how their tips are calculated and when payouts are coming. With visibility comes trust.

- Employees can see exactly how their tips are calculated and when payouts are coming. With visibility comes trust.

- Improve compliance and reporting

- Built-in recordkeeping and payroll integrations make it easy to stay compliant with tip pool distribution laws, IRS requirements, and wage regulations.

- Built-in recordkeeping and payroll integrations make it easy to stay compliant with tip pool distribution laws, IRS requirements, and wage regulations.

- Save managers hours each week

- Tip pooling distribution software removes manual entry and payout delays.

Simplify tip distribution with eTip

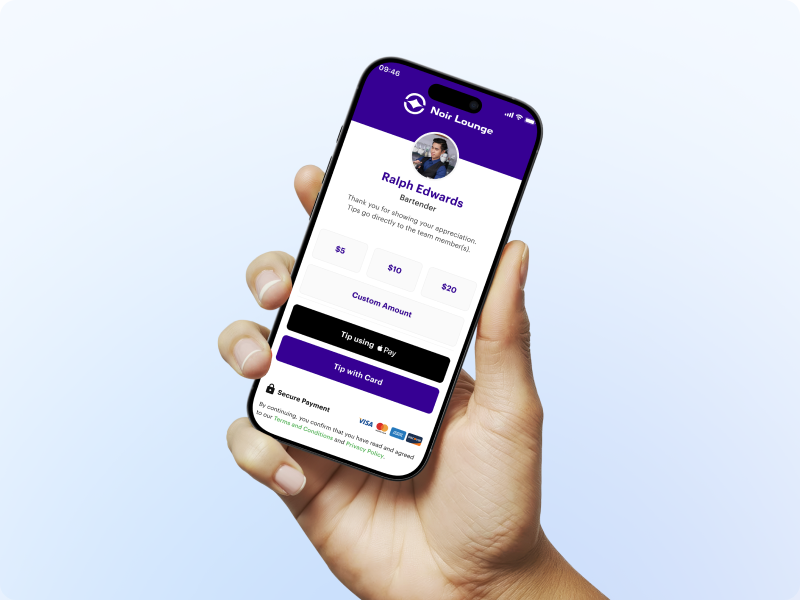

eTip makes it easy for restaurants, hotels, and service businesses to track, allocate, and distribute tips quickly and accurately.

eTip offers:

- Real-time tip tracking

- Employees can see their tips instantly from a convenient app.

- Automated payments

- Ensures timely, direct tip deposits without manual effort.

- Effortless compliance

- Automatically records tips for payroll and tax reporting, reducing liability.

- Cashless convenience

- Guests can tip via QR codes, credit cards, or mobile payments.

- Customizable tip distribution rules

- Allows your business to set fair and transparent tip-sharing structures based on your specific needs.

FAQs

Tips at restaurants are typically distributed using one of three methods:

1. Tip pooling, where all tips are combined and split based on hours worked or role.

2. Tip sharing, where FOH staff share a portion of their tips with support staff.

3. Direct tipping, where employees keep the tips they personally earn.

Some restaurants also use a hybrid approach, blending 2 or more of the above methods.

Digital tipping platforms automate tip tracking, ensuring fair distribution while reducing manual errors and administrative workload.

Yes, but they must comply with federal and state wage laws. The Fair Labor Standards Act (FLSA) mandates that tips cannot be retained by employers and must be distributed fairly among employees.

Setting a suitable tip percentage distribution among employees varies by restaurant, but a common practice is allocating 10-20% of tips to support roles like bussers, hosts, and kitchen staff.

Businesses can transition to digital tipping by introducing QR code-based tipping, credit card processing, and mobile payment integrations. The easiest way to implement all of these is by investing in a digital tipping solution like eTip.

Join the eTip community!

We'll send the latest content & special releases directly to your inbox.

Ready to join the community?

Receive the latest & greatest content from eTip, sent directly to your preferred inbox!

![[CTA] Image - Retention 3 - 1200 x 627](https://no-cache.hubspot.com/cta/default/6775923/interactive-190476979887.png)