Are Cashless Restaurants Becoming the Norm in 2025?

Key takeaways

- Cashless transactions now dominate the restaurant industry, making up nearly 62% of U.S. restaurant payments in 2024.

- Going cash-free saves time, reduces financial errors, and improves security, but poses challenges around inclusivity and legal compliance.

- Multiple cities and states have passed laws requiring restaurants to accept cash to protect consumers who rely solely on cash payments.

- Digital tipping solutions like eTip streamline the tip process in cash-free restaurants, offering automated tip distribution, improved transparency, and easier compliance with tax and labor regulations.

- Despite the rapid rise of digital payments, fully cashless restaurants face significant barriers, suggesting a hybrid payment model will remain the norm in the near term.

Cashless payments are rapidly becoming the norm in the U.S. dining scene. As of 2024, only about 16% of all transactions nationwide were made with cash — a sharp decline that illustrates consumers’ pivot toward cards and mobile payments.

In the restaurant industry specifically, digital payments have surged: nearly 62% of restaurant transactions are now contactless or tap-to-pay. This shift suggests that consumer preferences are changing among American diners, who now largely prefer paying by card over cash when eating out.

Restaurants are responding by adopting point-of-sale systems that accept digital payments, and many new establishments are opening with “card and digital only” policies. Even traditional cash registers are giving way to sleek tablets and smartphone scanners in both quick-service and full-service restaurants, as momentum gains toward cashless operations.

In this article, we’re taking a closer look at what’s fueling the growing trend toward cashless restaurants, as well as the benefits and challenges this shift presents.

Government policies on cashless restaurants

The move to digital payments is not without oversight. There is currently no federal law that mandates private businesses to accept cash, which means restaurants can choose to go cash-free in many places.

However, concern for unbanked consumers has prompted action at the state and city level. By early 2024, at least eight U.S. states — including Massachusetts, New Jersey, Colorado, and Arizona — plus cities like New York, Philadelphia, and San Francisco have laws requiring businesses to accept cash.

These “cashless ban” laws ensure that customers who rely on cash are not turned away. In Congress, lawmakers have even proposed a federal “Payment Choice Act” to guarantee cash acceptance for in-person transactions, citing cash as a basic payment option that shouldn’t be eliminated.

Most operators carefully review their local laws, and some businesses have reversed cashless policies after legal pushback or customer complaints. In short, digital payments may be surging, but cash isn’t defeated yet — it remains a legally protected tender in many jurisdictions, forcing restaurants to balance innovation with inclusivity.

The benefits of going cashless

Going cashless offers restaurants significant operational and security advantages. Let’s look at the main benefits restaurants are reporting:

Time savings

Many operators find that ditching cash speeds up service and boosts efficiency. Without coins and bills changing hands, checkout is quicker – no more waiting for change or manually entering cash amounts.

Salad chain Tender Greens estimated that each cash transaction took 4–5 seconds longer than a card payment. Those saved seconds add up during a lunch rush.

Additionally, cashless operations streamline end-of-day closeout. Staff no longer spend time counting cash drawers and reconciling receipts, which can easily take 30–60 minutes or more.

This efficiency means employees and managers can focus more on food prep, customer service, and other tasks that improve the guest experience, rather than on tedious cash-handling chores.

Financial savings and fewer errors

Going cashless can also improve your restaurant’s bottom line by cutting certain costs. Handling cash isn’t free — restaurants incur bank fees for cash deposits, pay for armored transport or secure safes, and devote labor hours to counting and monitoring cash. By going digital, those expenses shrink.

Automation reduces human error as well: When every transaction is electronic, there’s zero risk of a cashier miscounting change or an employee pocketing a $20 by mistake. All sales are recorded automatically, yielding more accurate accounting — and it can simplify tax reporting and tip tracking, too.

In short, electronic payments tend to be precise and transparent, eliminating the small errors and losses that inevitably occur with cash in hand.

Security advantages

Cashless restaurants often cite safety as a big plus. Removing cash from the premises reduces the risk of theft (both internal and external).

Unfortunately, cash can be a magnet for crime. The Federal Reserve notes that U.S. retailers lose billions to employee theft (“shrinkage”) each year, and cash skimming is part of that loss.

Challenges and barriers to going fully cashless

Despite the upside, restaurants face several challenges if they attempt to go fully cash-free.

Inclusivity

One major concern is excluding customers who rely on cash. Millions of Americans remain unbanked or underbanked, meaning they don’t have credit cards or even bank accounts.

For these people, cash isn’t just a preference — it’s their only means of payment. This raises ethical and legal questions about accessibility and discrimination. A no-cash policy can also be seen as elitist or uncaring toward lower-income patrons.

The bottom line is that going 100% cashless may alienate some guests — and in the hospitality business, every guest’s comfort matters.

Legal challenges

Hand in hand with inclusion concerns are the legal barriers.

Multiple jurisdictions now require accepting cash. These laws vary — some apply statewide (e.g. New Jersey), others are city-level — but the trend is clear: completely cashless businesses are outright illegal in several parts of the country.

Thus, a nationwide chain can’t uniformly implement a cash-free policy; they have to carve out exceptions where laws demand cash acceptance.

Costs

Another challenge is the cost of electronic payments. Swiping cards and processing mobile payments isn’t free for businesses — payment processors charge fees on each transaction. Those fees cut directly into a restaurant’s thin profit margins.

By contrast, cash transactions incur no such percentage fee (a $20 bill in the register is $20 earned). For high-volume quick-service restaurants, card fees can add tens of thousands in expenses annually.

Should your restaurant go cashless?

Going cashless isn’t the right move for every restaurant, but it’s a decision worth exploring.

For most restaurant owners, the shift to digital payments can streamline operations, reduce risk, and improve the guest experience. Still, it’s important to take time to evaluate how the change will affect your business, staff, and guests before going cash-free.

Don’t go cashless until you’ve considered:

- Your customer base

Do most of your guests already pay with cards or mobile wallets, or do you serve a community that still relies heavily on cash? Check what percentage of your current sales are cash vs. digital. - Local regulations

Some cities and states require restaurants to accept cash, so carefully review local laws before rolling out a policy. - Technology readiness

Do you have the right POS system, payment processors, and digital tipping tools in place to handle a cashless business? - Staff training

Are your employees prepared to explain the new policy to guests and navigate questions or pushback? - Communication strategy

How will you let guests know about the change? Clear signage and messaging across touchpoints — menus, websites, receipts, and takeout packaging — are critical. - Backup plan

What happens if your payment system goes down? Building a contingency plan ensures your business can continue operating if your system crashes.

The role of digital tipping solutions in cashless restaurants

In cash-free restaurants, digital tipping solutions offer a slew of benefits, ensuring that employees receive fair, prompt, and transparent gratuities.

Implementing digital tipping in your cashless restaurant is a no-brainer, but you’ll need a reliable system to facilitate the process.

Using digital tipping software helps you:

- Accept tips for all employees, even back-of-house, which leads to happier staff and improved employee retention.

- Effortlessly split digital tips between staff according to your restaurant’s policies (split tips evenly, by shift, by role, etc.)

- Maintain detailed, compliant records of all digital tips to ease the process of IRS reporting and labor law compliance

- Pay out tips quickly and easily

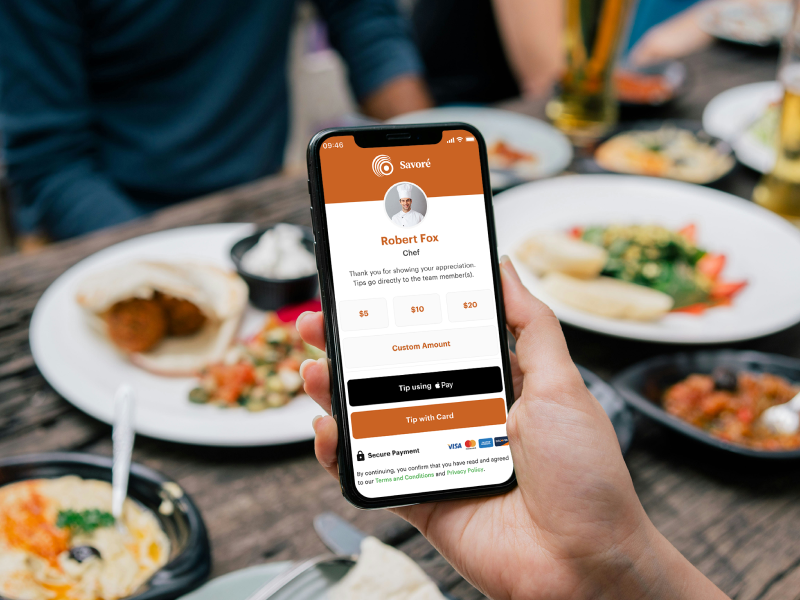

Accept cashless tips with eTip

eTip is the leading digital tipping solution built specifically for restaurants and hospitality businesses. With a simple QR code or link, guests can leave a tip in seconds using their phone — no cash or app download necessary.

For owners and managers, eTip does more than just capture gratuities.

It helps you:

- Support all staff members — from FOH to BOH — with digital tipping that boosts retention and morale

- Distribute tips seamlessly using customizable rules based on hours, role, or shift

- Stay compliant with automatic IRS-ready reporting and labor law transparency

- Simplify payroll by sending tips directly to employees or integrating with your existing payroll system

- Elevate the guest experience with a branded, modern, and convenient tipping process

With eTip, cashless restaurants can protect staff income, improve transparency, and keep pace with guest expectations in today’s cash-free economy.

Looking ahead: Will the restaurant industry go fully cashless?

The hospitality industry’s trend towards digital payments looks strong, but the timeline for a completely cash-free industry is nuanced. Industry forecasts and expert predictions indicate that digital payments will continue to grow and dominate.

Many restaurateurs interpret these signals as a cue that investing in cashless capabilities (like robust POS systems, digital tipping solutions, and mobile ordering apps) is key to staying competitive.

Younger consumers, especially Gen Z and millennials, are so accustomed to digital wallets and tap-to-pay that they may eventually view cash-only establishments as inconvenient or outdated. As these demographics compose a larger share of the dining public, their preferences could effectively nudge more restaurants into becoming cash-free.

In all likelihood, the restaurant of 2030 and beyond will handle very little physical cash, but it’s unlikely that cash will vanish entirely across the industry in the immediate future. We’re more likely to see a hybrid approach continue for a while: restaurants heavily promoting digital payments while still keeping a cash drawer tucked away to remain inclusive and compliant. Over time, as the infrastructure and societal norms continue to tilt toward cashless convenience, that drawer may disappear.

Cashless restaurant FAQs

No, not everywhere — but it is illegal in some places. Several cities and states — including New York, Philadelphia, San Francisco, and New Jersey — have laws requiring restaurants to accept cash to ensure all consumers can pay.

The main advantages are faster transactions, reduced theft and cash-handling risks, fewer errors in payments, and simplified accounting and payroll processes.

eTip enables easy, fair, and automated tip distribution, provides instant payouts to employees, improves IRS compliance, and increases transparency in tip reporting.

While digital payments are growing rapidly, complete cash elimination faces regulatory and inclusivity hurdles. A hybrid approach is likely to prevail for several years.

Join the eTip community!

We'll send the latest content & special releases directly to your inbox.

Ready to join the community?

Receive the latest & greatest content from eTip, sent directly to your preferred inbox!

![[CTA] Image - Tip Payouts 3 - 1200 x 627](https://no-cache.hubspot.com/cta/default/6775923/interactive-190476651600.png)