Tip Reporting in Hospitality: What Employers Need to Know

If you’ve ever had to chase down handwritten logs, cross-check manager spreadsheets, and still felt unsure if everything would line up at tax time, you know the stress of reporting tips to the IRS.

Tip reporting isn’t complicated in theory, but in practice, it’s a tangle of deadlines, thresholds, and paperwork that steals hours you don’t have.

This guide breaks it down for managers and owners at restaurants, hotels, car washes, and every other service business. You’ll learn exactly what the IRS expects, what your responsibilities are as an employer, and how to make IRS tip reporting so seamless it stops being a monthly headache.

Tip reporting 101: What it is and why it matters

Tip reporting refers to tracking all the tips your employees earn — cash, credit card, or pooled — and making sure they’re reported to the IRS.

It’s not optional, and it’s not just for restaurants. Hotels, bars, salons, spas, valet stands, car washes, tour operators — if your staff earns tips, they need to be reported.

Why tip reporting matters:

- It’s the law.

The IRS requires employees to report all cash tips totaling $20 or more in a month to their employer, who then withholds the appropriate payroll taxes. - It protects your business.

Accurate reporting reduces the risk of audits, penalties, and reputational damage. - It’s fair to your staff.

Reported tips count toward taxable wages, which impacts Social Security, Medicare contributions, and accurate end-of-year W-2s. - It’s an industry focus.

The IRS pays close attention to tipped industries, and they’ve created compliance programs aimed squarely at hospitality and service businesses.

What are the IRS rules on reporting tips?

The IRS has clear guidelines for how tips should be reported, who’s responsible, and when it needs to happen.

While the specifics can get technical, the core rules are straightforward:

- Employees must report tips to their employer

Any employee who earns $20 or more in tips in a single month is required to report that total to their employer. This includes tips received directly from customers, tips paid through credit or debit cards, and any share of pooled or split tips. - Employers must include reported tips in payroll

Once tips are reported, you’re responsible for withholding income, Social Security, and Medicare taxes — just like you would for regular wages. - Tips are taxable income

All tips, whether cash, credit, or electronic, are considered taxable by the IRS. This includes allocated tips, which are tips you report on behalf of employees if records suggest they underreported their actual earnings. - Reporting deadlines matter

Employees must report tips to you by the 10th of the following month. Missing that deadline can create serious headaches, especially if you have to make corrections after payroll runs. - Recordkeeping is required

The IRS expects both you and your employees to maintain accurate records of all tip income. In an audit, sloppy or incomplete records are a red flag.

Pro tip: Even if an employee earns less than $20 in tips for the month, it’s still smart to track them. Once their monthly total crosses that threshold, you’ll have the documentation ready.

Note: Impact of the No Tax on Tips bill

The “No Tax on Tips” bill was signed into law in July 2025.

Starting with the 2025 tax year, eligible workers will be able to deduct up to $25,000 in reported tip income from their federal income tax. Employees will still have to pay Social Security and Medicare taxes on their tips, even if they claim the income tax deduction.

Read more → What the “No Tax on Tips” Bill Means for Hospitality Teams

Are tips taxed differently than wages?

Not really — at least not in the way most people think.

Tip income is taxed the same as regular wages when it comes to federal income tax, Social Security, and Medicare. The difference is in how the taxes are calculated and reported.

With wages, your payroll system knows the amount in advance and withholds the correct taxes automatically.

Tips are variable and reported after the fact, which means:

- Employees report their monthly total to you, and those amounts get added to their paycheck for tax withholding purposes.

- Employers withhold the appropriate taxes and include tips as part of taxable income on the employee’s W-2.

Some employees worry that tips get “taxed twice” — once when received and again at tax time. That’s not true. Taxes are withheld once, just like wages, and reflected in year-end totals. The confusion often comes from the fact that credit card tips may appear in paychecks (after tax) even though the employee already “has” the money in their mind.

The takeaway: For IRS purposes, a dollar in tips is treated the same as a dollar in wages — but the reporting process requires more coordination between employees and employers.

Will I get in trouble for not reporting tips?

Short answer: yes, you’ll get in trouble for not reporting cash tips to the IRS.

Both employers and employees can face consequences for not reporting (or underreporting) cash tips.

For employees, failing to report tips of $20 or more in a month to their employer can lead to:

- IRS penalties equal to 50% of the Social Security and Medicare taxes owed on those unreported tips

- Additional back taxes and interest if the IRS determines income was underreported

- Lower Social Security and Medicare benefits later in life, since those benefits are based on reported earnings

For employers, the stakes can be higher:

- Liability for unpaid payroll taxes on unreported tips

- Fines for inaccurate W-2s

- Risk of an IRS audit, especially in industries known for tipping

If the IRS believes a business is intentionally misreporting or ignoring tip reporting, they may escalate from issuing warning letters to conducting a full audit.

Tip reporting responsibilities for employers

If your business has tipped employees, you’re in charge of IRS tip reporting.

While employees are required to report their tips to you, you’re responsible for ensuring those tips get properly documented, reported, and taxed.

Here’s what that means in practice:

1. Know the reporting threshold

Employees must report $20 or more in cash tips in a single month. Once reported, you must add those tips to payroll, withhold the appropriate federal income, Social Security, and Medicare taxes, and include them on W-2s at the end of each year.

2. Understand allocated tips

If your reported tips are less than 8% of your gross receipts (or a lower rate approved by the IRS), you may have to assign allocated tips to employees. These are extra tip amounts reported to the IRS based on sales data, not on what the employee actually reported — and they appear separately on the employee’s W-2.

3. Integrate tips into payroll

Your goal is to get accurate tip data into payroll quickly so withholdings are correct from the start. We recommend using tip reporting software to facilitate.

4. Keep meticulous records

The IRS expects you to maintain detailed records of all reported tips, allocated tips, and related payroll taxes. In an audit, these records are your first line of defense.

Pro tip: Linking your POS or digital tipping platform directly with payroll can eliminate manual data entry and reduce reporting errors.

Tip reporting responsibilities for employees

Employees are the starting point of the tip reporting process. If they don’t record and submit accurate totals, your payroll and IRS filings will be off.

Employees are responsible for:

- Tracking their tips daily — cash, credit, pooled, or digital

- Reporting totals of $20 or more in a month to you by the 10th of the following month

Be aware of common misconceptions — like thinking small cash tips don’t need to be reported or assuming credit card tips are “already taxed.” Both are false, and both can create compliance issues for you if employees aren’t trained correctly.

How does tip reporting work?

- Employees track tips

Each shift, employees log all tips they receive — cash, credit, pooled, or digital. This can be done with a paper log, POS system, or tip reporting software. - Monthly reporting to the employer

Employees must report tips to you by the 10th of the following month. Many businesses collect this data automatically through a POS or digital tipping platform to avoid manual work. - Employer integrates tips into payroll

Reported tips are added to the employee’s taxable wages, and payroll taxes (income tax, Social Security, Medicare) are withheld. - IRS reporting

Employers include tip income on W-2 forms and in quarterly tax filings. If allocated tips are required, they’re listed separately on the W-2. - Recordkeeping

Both you and your employees should keep detailed records. The IRS may request these in an audit, and having a clear paper trail can save you from penalties.

How to track and report your employees’ tips to the IRS

For busy hospitality operators, the challenge is to build a tip reporting process that’s accurate, repeatable, and low-maintenance. The IRS doesn’t care if you run a single café or a 500-room hotel — they expect clean records and timely reporting either way.

- Capture tip data at the source

- Use your POS, property management system, or tip reporting software to record credit card and digital tips automatically.

- Have a clear process for collecting cash tip totals from employees at the end of each shift or pay period.

- Consolidate data for payroll

- Combine employee-reported cash tips with system-recorded electronic tips.

- Ensure all tips are added to payroll before taxes are calculated.

- Meet monthly deadlines

- Make sure employees submit tip totals by the 10th of the following month.

- Make sure employees submit tip totals by the 10th of the following month.

- Calculate and withhold taxes

- Withhold federal income, Social Security, and Medicare taxes on all reported tips, just as you would for wages.

- Keep an eye on allocated tips if your reported total is less than 8% of gross receipts.

- File and store records

- Include tip income in quarterly IRS filings and year-end W-2s.

- Keep detailed records — the IRS recommends retaining tip reports for at least four years.

By automating as much of this process as possible, you reduce errors, save time, and avoid the month-end tax scramble.

How to simplify tip reporting

Manually reporting tips takes forever and leaves too much room for error — especially if you manage multiple departments, locations, or shifts. The best way to protect your business (and your sanity) is to streamline the IRS tip reporting process with tools that do the heavy lifting for you.

Digital tipping systems make it easier to report tips

If you want to simplify your tip reporting process, we recommend investing in a digital tipping solution — and not just because digital tips are easier to track and report than cash tips.

Digital tipping systems capture tip data automatically and keep it all in one secure dashboard, where you can see and track all your team’s tips in one place.

The best platforms don’t just record the data, but organize it for IRS compliance, cut down on manual admin, and feed accurate totals straight into payroll.

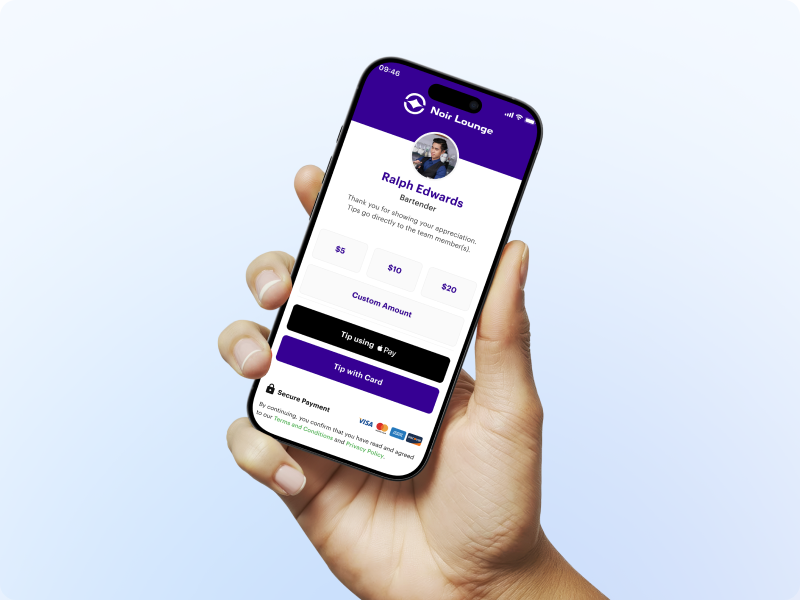

Use eTip to simplify tip reporting

eTip is the hospitality and service industry’s leading digital tipping and tip management platform, trusted by thousands of hotels, restaurants, and service businesses across the U.S.

Not only can eTip help guests leave tips digitally, but it’s also one of the most powerful tools available for simplifying tip reporting. With eTip, tip data is automatically organized, tracked, and prepared for IRS compliance.

Here’s how eTip streamlines reporting:

- Automatic, IRS-ready reports you can download on demand or schedule for payroll periods

- Real-time dashboards so you can monitor reported tips across departments, shifts, and locations

- Built-in allocations to split tips by individual, team, shift, or percentage without manual math

- Seamless payroll integration so reported tips flow directly into your payroll system with correct tax withholdings

- Secure recordkeeping that meets IRS retention guidelines, ensuring you’re prepared in the event of an audit

With eTip, tip collection and reporting happen in the same system — so the compliance work gets done as the tips come in, not weeks later.

FAQs

Are tips taxed twice?

No, tips are only taxed once.

The confusion comes from timing: When credit card tips are processed through payroll, employees see them in their paycheck after taxes are withheld, which can feel like they’re being “double taxed.”

In reality, tips are treated like wages for federal income, Social Security, and Medicare taxes, and withholding happens just once before the final amount is paid out.

What is IRS Form 4070 and when is it used?

IRS Form 4070, “Employee’s Report of Tips to Employer,” is how employees officially report their monthly tip totals to you. It must be submitted by the 10th of the following month if their cash tips are $20 or more.

What happens if I don’t report tips?

Not reporting tips — whether you’re an employee or an employer — can lead to penalties, back taxes, and even IRS audits.

- For employees: The IRS can assess a penalty equal to 50% of the Social Security and Medicare taxes owed on unreported tips, plus interest.

- For employers: You may be liable for unpaid payroll taxes, face fines for inaccurate W-2s, and risk reputational damage if you’re found noncompliant

Join the eTip community!

We'll send the latest content & special releases directly to your inbox.

Ready to join the community?

Receive the latest & greatest content from eTip, sent directly to your preferred inbox!

![[CTA] Image - Compliance 3 - 1200 x 627](https://no-cache.hubspot.com/cta/default/6775923/interactive-190476979820.png)

![[CTA] Image - Compliance - 1200 x 627](https://no-cache.hubspot.com/cta/default/6775923/interactive-190476979801.png)