What the “No Tax on Tips” Bill Means for Hospitality Teams

A federal tax shake-up is coming for the hospitality industry.

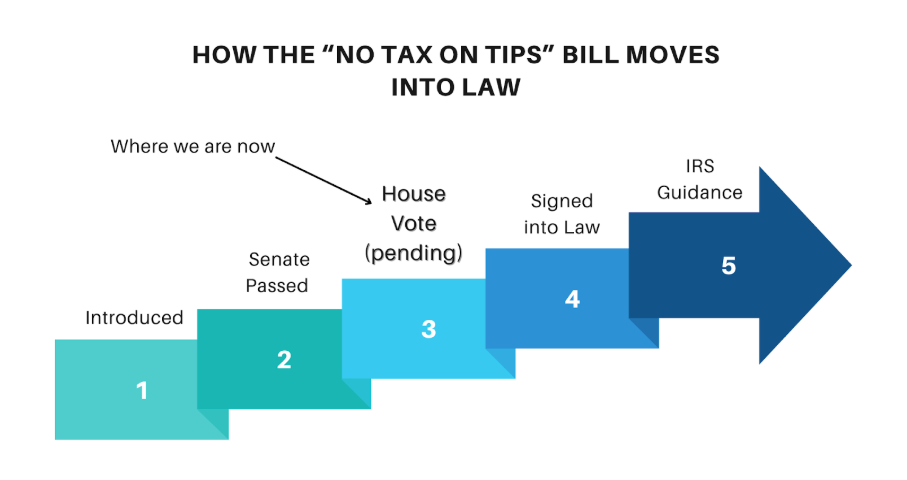

The U.S. Senate has officially passed the “No Tax on Tips Act,” a landmark piece of legislation that could fundamentally change how service workers are taxed on gratuities.

Backed by Senator Ted Cruz and Donald Trump, it’s now one House vote away from becoming law.

If enacted, this will mark a major overhaul for the whole industry.

Not only will the no tax on tips bill positively affect the earnings of more than 4 million tipped workers, but it will lead to a complete overhaul with regard to how hotel operators and HR teams handle compensation and tip reporting.

What exactly changes? What’s still unclear? And how can you prepare before this becomes law? Scroll on for a detailed breakdown.

Where the Legislation Stands Now

On May 21, 2025, the U.S. Senate passed the “No Tax on Tips Act” with unanimous bipartisan support.

The bill now heads to the House, where it’s widely expected to pass. This is due to its strong backing from the hospitality industry and labor groups.

This legislation comes after months of media attention and grassroots campaigning from service workers.

The American Hotel & Lodging Association (AHLA) has endorsed the bill, calling it a win for frontline teams and a better fit for how tipping works today.

While not yet law, it’s moving faster than anticipated. Many in the industry expect it to reach the President’s desk, and take effect, within the next fiscal quarter.

What the Bill Actually Says

So what does the bill actually say? The No Tax on Tips Act of 2025 is short but significant. Here’s what it covers based on current language:

- Federal income tax exemption for all reported tips earned by employees making under $250,000/year

- Applies to both cash and digital tips, though formal IRS guidance is still expected to confirm this

- Employees must still report tips to employers, but those tips won’t count toward taxable income at the federal level

- Employers remain responsible for tracking and reporting tip income accurately

Of note, there are not yet any clear instructions from the IRS on enforcement, and there’s no word on retroactive application of the bill (though this is in discussion).

Importantly, this does not exempt tips from all taxes. Social Security and Medicare contributions (FICA taxes) may still apply, and state tax treatment will vary unless new legislation is passed at the state level.

What Does “No Tax on Tips” Mean for Service Workers?

At its core, the No Tax on Tips Act would exempt service workers from paying federal income tax on the tips they receive, a big shift from the existing rules, where all tips (cash or digital) are considered taxable income.

This change is being positioned as a way to give more money back to workers in sectors like hospitality, where tipping remains a key part of total compensation.

Right now, workers are required to report tips over $20/month to their employer, and businesses must then report and withhold tax accordingly. Failure to report, whether accidental or intentional, can create compliance problems for both staff and payroll teams.

By removing the tax burden on tips, proponents of the bill argue it simplifies things for everyone: more take-home pay for workers, and less paperwork and liability for employers.

At the time of writing, the legislation has passed the Senate but still awaits a House vote before landing on the President’s desk. Early versions of the bill did not include detailed IRS enforcement guidance, which means the exact process for compliance, payroll reconciliation, and staff reporting may take months to clarify.

What Operators Need to Start Thinking About

For operators, this bill is more than a tax change. It’s a huge shift in how tipping is managed and accounted for across your business.

Most hotels today have some mix of cash, pooled, and digital tips, with wildly different levels of visibility and reporting across departments. This legislation doesn’t eliminate your tracking responsibilities, but it changes the stakes.

Here’s what that looks like in practice:

- Digital tipping infrastructure – Can your system handle fast changes to tip classification and tax treatment?

- Payroll flexibility: Is your team ready to adapt to a different withholding approach if federal guidance shifts?

- Audit risk: Are you ready to clearly distinguish between taxed base wages and untaxed tip income, especially if the IRS scrutinizes how this law is applied?

- Staff communication: If passed, this law will create confusion. Your teams will need guidance on how tip reporting works, what has changed, and what remains the same for them.

Many operators who currently manage tips manually, especially with cash-based pools or ad hoc distributions, may struggle to meet any new recordkeeping standards.

That’s why digital systems will become more critical, even in a no-tax environment. A transparent, compliant digital tipping solution gives your team the flexibility to adapt quickly without adding new administrative burdens.

One of the biggest questions surrounding the No Tax on Tips Act is whether all tips will be treated equally, or whether cash and digital tips will be handled differently under the new rules.

At present, there’s no official confirmation from the IRS or Treasury on how the new law, if fully enacted, would distinguish between cash, card-based, and digital tips. But this distinction matters, because each has different levels of traceability and reporting burden.

How the IRS Currently Handles Tips

Right now, the IRS treats all tips as taxable income. If you run a hotel or hospitality business, that means:

- Employees are legally required to report monthly tip earnings over $20 to you using the IRS Form 4070.

- You’re required to include those tips in wage statements, calculate income tax withholding, and apply FICA (Social Security and Medicare) contributions accordingly.

- If tips come through digital channels, like credit card terminals, mobile apps, or digital tipping platforms, the IRS assumes what’s reported is accurate since it’s logged in the same systems as wages.

In simple terms, cash tips rely on employees to self-report, while digital tips are automatically tracked and harder to underreport.

This has two major implications:

- Digital tips are more audit-proof because they create a clear, time-stamped trail that payroll and compliance teams can refer back to.

- You’re more accountable for digital tip compliance. If your platform routes tips through payroll, you’re already reporting and withholding taxes as required. That also means you’ll need to be ready to adjust this setup quickly if legislation changes

If Tips Become Tax-Free, What Changes?

If the No Tax on Tips Act becomes law and applies to all tips – both cash and digital – it would be a major operational shift for hospitality businesses.

It would mean:

- No more federal income tax withholding on tips

- No need to report tip income as part of taxable wages

- Simplified payroll and cleaner paychecks for tipped staff

For operators using digital tipping systems, this would reduce complexity overnight. It would also mean higher take-home pay for staff, without requiring base wage increases.But that’s only if all tips are included.

How Operators Should Prepare, Even Before IRS Guidance Arrives

The Senate has passed the No Tax on Tips Act, and House approval is widely expected. But final IRS instructions – the kind that dictate exactly how to handle payroll and reporting – may still be weeks or months away.

That doesn’t mean you can wait.

Delaying prep could leave you scrambling once the new rules go live. Operators who start now will be better equipped to adjust payroll processes and stay ahead of compliance risk, even if the specifics are still in flux.

Here’s how to start preparing now, before guidance is in hand.

1. Start Tracking Tips Separately

Even though tip income is still taxable for now, this is the time to make sure your systems can clearly separate tip earnings from base wages. That clarity will matter if some or all tips become exempt from federal income tax.

Here’s what you can do today:

- Audit your POS or digital tipping system: Can it flag tip income separately from hourly pay?

- Work with payroll to label tips clearly: Make sure there’s a distinct field or classification that keeps tips isolated in reporting.

- Train managers to distinguish service charges from tips: This line will matter more than ever if exemptions don’t cover automatic gratuities.

The goal isn’t to make assumptions about how the IRS will enforce this but to be ready for either scenario.

2. Assess the Risk of Over-Withholding

If tip income becomes tax-exempt but your payroll system continues to withhold taxes, your staff could see smaller paychecks than they expect.

This means you could end up issuing backdated corrections or reimbursements.

Meanwhile, your team may lose confidence in the system if their take-home pay doesn’t match headlines they’re seeing.

Now is the time to talk to payroll vendors and your tipping platform about how quickly settings can be updated once IRS guidance lands.

3. Prepare for Staff Questions

If your team hasn’t started asking about the “no tax on tips” headlines yet, they will soon. Service workers – especially those in housekeeping, valet, food & beverage, and bell services – want to know what this means for their paychecks.

The best answer for now is:

“We’re watching closely, and we’ll be ready to make changes as soon as final guidance is published. Right now, we’re working behind the scenes to make sure your tips are clearly tracked so that we’re set up to move fast once it’s official.”

This transparency will build trust with your team, even if there’s no immediate change to report.

4. Revisit Your Tipping Infrastructure

Whether tips are taxed or not, you still need a system that tracks them cleanly and reliably, and keeps the data audit-ready.

eTip has been built for this exact moment. It can:

- Capture every tip with a timestamp and recipient

- Pay out earnings directly and transparently

- Separate service charges from true tips

- Adjust tax handling centrally when the rules change

Now let’s take a closer look at what operators should be cautious of, and where this could go wrong if teams are caught off guard.

Why Digital Tipping Systems Make Sense Right Now

With tipping legislation changing and compliance likely to shift quickly, hotels and service businesses need systems that offer clarity and audit-readiness. Manual tip tracking is becoming harder to justify.

This is why digital tipping solutions are rapidly becoming the new norm.

And for operators looking to future-proof their compliance and support their teams, solutions like eTip offer a clear path forward.

Let’s delve into some of the specific benefits operators using eTip are seeing.

Seamless Payouts, Even at Volume

If tips become tax-exempt, expectations around speed will go up fast. Employees will expect to see them hit their account the same day. And withholdings no longer holding things up, there’s no reason they shouldn’t.

That’s where operational pressure builds, unless you have a system built to handle it.

eTip is designed for exactly this. There’s no delay between a guest tipping and the employee receiving their earnings. Staff can choose how they get paid, whether that’s direct deposit, PayPal, Venmo, or even an instant debit card transfer.

There’s no cash to count or manual spreadsheet updates at the end of the shift. Just fast, accurate payouts that keep your team happy and your admins with more time freed up for other tasks.

And because it’s fully automated, it scales, whether you’ve got 15 staff or 500 across multiple properties.

Clarity for Staff and Managers

This law is going to spark questions, both from your team and potentially from auditors. eTip brings much-needed visibility to everyone involved.

For staff, tips are tracked individually with full visibility into amounts and payout method.

Managers meanwhile have access to real-time dashboards showing tips by shift, team, or property.

This leads to less spent resolving disputes, and offers clearer breakdowns for HR and finance purposes.

What Happens Next

With the “No Tax on Tips” legislation now through the Senate and House approval expected shortly, the hospitality industry is staring down a seismic shift in how tips are handled.

The fine print is still taking shape. It’s not yet clear whether digital and cash tips will be treated the same, or what enforcement will look like. But one thing is certain: federal income tax on tips is on its way out. For workers, that’s a win. For operators, it’s a change that demands preparation.

Hotels and restaurants that still rely on cash pools or outdated POS workarounds will find it harder to keep up. If the No Tax on Tips bill is implemented, visibility and audit readiness will become requirements (rather than perks).

If your business doesn’t yet have a digital system to manage tips effectively, this is the moment to act.

Whether tips become fully tax-exempt or treated differently depending on how they’re paid, a platform like eTip gives you the infrastructure to respond quickly, without rebuilding your processes from scratch.👉 Schedule a quick demo to see how eTip can make digital tipping easy, effective, and future-proof.

Frequently Asked Questions

It means federal income tax would no longer be applied to tip income for eligible workers, though FICA and state tax rules may still apply.

While the Senate passed the bill, it still needs to clear the House. Most experts anticipate final approval by the end of Q3 2025.

As of now, no. But a vote is expected soon, and early signals suggest strong support.

Join the eTip community!

We'll send the latest content & special releases directly to your inbox.

Ready to join the community?

Receive the latest & greatest content from eTip, sent directly to your preferred inbox!

![[CTA] Image - Generic - 1200 x 627](https://no-cache.hubspot.com/cta/default/6775923/interactive-190476979828.png)

![[CTA] Image - Generic 2 - 1200 x 627](https://no-cache.hubspot.com/cta/default/6775923/interactive-190476979840.png)