What’s a Tip Credit? In-Depth Guide for Employers

Tip credits are an overwhelmingly misunderstood topic in hospitality payroll. Ask 10 managers and you’ll probably 10 ten slightly different answers.

But understanding tip credits is both a legal obligation and a key factor in keeping staff happy, staying compliant with wage laws, and maintaining efficient operations.

If you’re confused about how tip credits work, we’re here to help.

This guide covers:

- What a tip credit means

- Who tip credits apply to

- Local and federal laws around tip credits (in plain English)

- How to calculate tip credits

- How digital tipping solutions make it easier to manage tip credits

What is a tip credit?

A tip credit is a way for employers to count part of an employee’s tips toward the federal minimum wage requirement ($7.25/hour as of August 2025).

In other words, the tip credit is what allows an employer to pay staff less than the minimum wage (so long as staff’s tips bring their total pay up to or above the minimum wage).

Tip credits are not a deduction. They’re just a figure used to calculate wages.

If you intend to claim a tip credit (i.e. pay employees less than the minimum wage), you must let the government know.

We know — it’s pretty confusing. We’ll dive into more detail below to continue clearing things up.

Brief history of tip credits

Tip credits were formally introduced in 1966 when Congress amended the Fair Labor Standards Act (FLSA) to recognize tipped wages.

The intention was straightforward: In industries where tipping was standard, employers could pay staff less than the minimum wage without legally underpaying. The tip credit was originally designed to help hospitality and service businesses reduce payroll costs.

Over the years, updates have refined tip credit eligibility, recordkeeping requirements, and maximum credit amounts.

Several states, however, have opted out entirely. Alaska, California, Minnesota, Montana, Nevada, Oregon, and Washington require employers to pay the full minimum wage before tips.

Who qualifies for a tip credit?

Tip credits apply only to employees who:

- Regularly receive more than $30 in tips per month (the federal definition of a “tipped employee”).

- Work in industries where gratuities are a standard part of compensation, such as food service, hospitality, parking, salons, car washes, and tourism.

- Are not managers or supervisors (in most cases)

It’s also worth noting that the tip credit can only be applied to tipped work. That means employers have to pay the full minimum wage for time an employee spends conducting non-tipped work.

Here’s an example to illustrate that:

Server Amy spends 6 hours of her shift performing typical serving duties — taking orders and delivering food to tables. After those 6 hours though, Amy spends 2 hours cleaning the kitchen, stocking the walk-in, and performing other admin duties.

In this case, the restaurant can only apply a tip credit to the 6 hours Amy spent on service tasks, not to the 2 hours she spent on non-service tasks.

How tip credits work for employers

The law allows part of an employee’s wage obligation to be satisfied by tips, but only if everything adds up correctly.

That means employers need to be diligent: track wages, track tips, and always double-check that the numbers meet or exceed minimum wage requirements.

Here’s a high-level overview of how tip credits work:

- Employer pays a base cash wage (e.g., $2.13/hour).

- Employee earns tips throughout their shift.

- If total pay (wages + tips) equals or exceeds $7.25/hour, the employer has met FLSA requirements.

- If not, the employer must make up the difference.

Related reading → What the “No Tax on Tips” Bill Means for Hospitality Teams

Summary of laws surrounding tip credits

- Federal baseline

The FLSA allows a $5.12 maximum credit toward the $7.25 minimum wage.

- Employee notification requirement

Employers must alert employees that their tips are being credited toward the minimum wage.

- Dual jobs rule

Employers can’t take a tip credit for time employees spend on unrelated non-tipped duties.

- Non-exempt

Most employees you claim a tip credit for will be classified as non-exempt, meaning FSLA standards like overtime pay apply.

- Employer responsibility to meet minimum wage

If any employee’s total wages + tips don’t add up to at least the minimum wage, employers are required to pay the difference.

- Record keeping

Employers must document cash wages, tips, and distributions.

For the official word, the Department of Labor’s Fact Sheet #15 is the go-to reference.

State laws on tip credits

Tip credit laws vary across the country because many states have a higher minimum wage than the federal minimum.

State minimum wages vary from state to state. Use this chart from the U.S. Department of Labor to determine the minimum cash wage in your state.

Additionally, many states have opted out of the tip credit.

Tip credits are illegal in:

- Alaska

- California

- Minnesota

- Montana

- Nevada

- Oregon

- Washington

On top of that, many states that do allow a tip credit require a higher direct or cash minimum wage be paid to employees.

About the FICA tip credit for employers

Separate from wage compliance, hospitality businesses may also be eligible for the FICA tip credit, which is a valuable tax incentive.

FICA stands for the Federal Insurance Contributions Act. This law requires both employees and employers to contribute to two major federal programs:

- Social Security (currently 6.2% of wages for each side)

- Medicare (currently 1.45% of wages for each side)

Together, these add up to 7.65% of every employee’s wages, matched by the employer. That means when a tipped employee earns $500 in tips, the employer must also pay 7.65% in payroll taxes — even though those tips came from guests, not the business itself.

That’s where the FICA tip credit comes in. Recognizing that it’s a heavy burden for industries built on tipping, Congress created a tax credit that allows employers to reclaim some of those costs.

Here’s how it works:

- Employers still pay FICA taxes on all reported tips.

- However, employers can then recover the taxes they paid on any “excess tips” — that is, tips earned beyond what was required to bring the employee’s total pay up to the federal minimum wage.

For the authoritative word, check the IRS’s FICA tip credit guidance.

Example of the FICA tip credit

Server Amy works 40 hours. At $7.25/hour, the federal minimum wage requirement is $290.

You pay Amy $2.13/hour ($85.20), so she needs at least $204.80 in tips to reach $290.

Say Amy earns $600 in tips. In this case, $395.20 is considered “excess.”

As a result, you pay 7.65% FICA taxes on all $600 — but you can claim a credit for your share of FICA taxes on that $395.20.

How to claim the FICA tip tax credit

All you have to do is fill out and file IRS form 8846 (Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips) when you do your annual tax return.

How to calculate tip credits: step-by-step guide + examples

Your business’s maximum tip credit = the local minimum wage minus the local minimum cash wage.

Let’s break that down:

Step 1: Start with the federal minimum wage

The federal baseline is $7.25/hour. Your state may have a higher minimum — if so, use that figure instead.

Step 2: Determine the cash wage you’re paying tipped employees

Federal law allows you to pay as little as $2.13/hour in direct wages, though some states set a higher tipped minimum wage or ban tip credits altogether.

Refer to this chart from the DoL to determine your state’s minimum cash wage.

Step 3: Subtract cash wage from minimum wage

The difference is your maximum allowable tip credit.

- Example: $7.25 – $2.13 = $5.12 (maximum credit per hour under federal law).

Step 4: Track actual tips earned

This is where many a lot of business owners stumble. You need accurate records of reported tips each pay period, not estimates or pooled totals.

Step 5: Verify that wages + tips = at least minimum wage

If the combination of cash wages and tips doesn’t meet or exceed the minimum wage, you’re required to pay the difference.

Detailed examples of tip credit calculations

Example 1: Employee meets minimum wage with tips

- Bartender John works 25 hours

- John’s cash wage: 25 × $2.13 = $53.25

- John’s tips earned: $250

- Total earnings = $303.25, or $12.13/hour

✅ This exceeds $7.25/hour, so the employer can apply the full tip credit.

Example 2: Employer must supplement wages

- Server Rose works 20 hours

- Rose’s cash wage: 20 × $2.13 = $42.60

- Rose’s tips earned: $50

- Total earnings = $92.60, or $4.63/hour

❌ This falls short of $7.25/hour. The employer must add $2.62/hour × 20 = $52.40 to cover the gap.

Example 3: State law requires higher minimum wage

- In Colorado, the minimum wage is $15/hour (2025), but the minimum cash wage is $2.23.

- If a tipped employee earns $3/hour in cash wages, the maximum tip credit per hour is $12.

- Employers must confirm that cash wages + tips meet $15/hour, not $7.25.

Common tip credit pitfalls to avoid

- Assuming tips will “always” cover the gap

Occupancy dips, weather, or slow seasons can leave employees under minimum wage. - Ignoring state laws

Some states (like California) prohibit tip credits entirely. - Forgetting dual jobs

If a server spends part of their shift cleaning or prepping (non-tipped tasks), you may not be able to claim the credit for those hours. - Poor recordkeeping

Without reliable tracking, you risk compliance violations, back pay, and penalties.

Tip pooling and tip credits

Tip pooling — where staff combine tips and distribute them according to the business’s policy — adds another layer of complexity.

Employers can still use the tip credit, but only under certain conditions:

- Only employees who customarily receive tips (servers, bussers, bartenders) can share in a mandatory pool if the credit is claimed.

- Back-of-house staff (cooks, dishwashers) may participate only if employers pay the full minimum wage without using a credit.

This is why managers who want to enforce tip pooling also need to understand tip credits. Mismanaging either piece can create compliance issues or leave staff feeling frustrated or underpaid.

Pro tip: Use our tip pooling calculator to run scenarios and test distribution models before rolling them out.

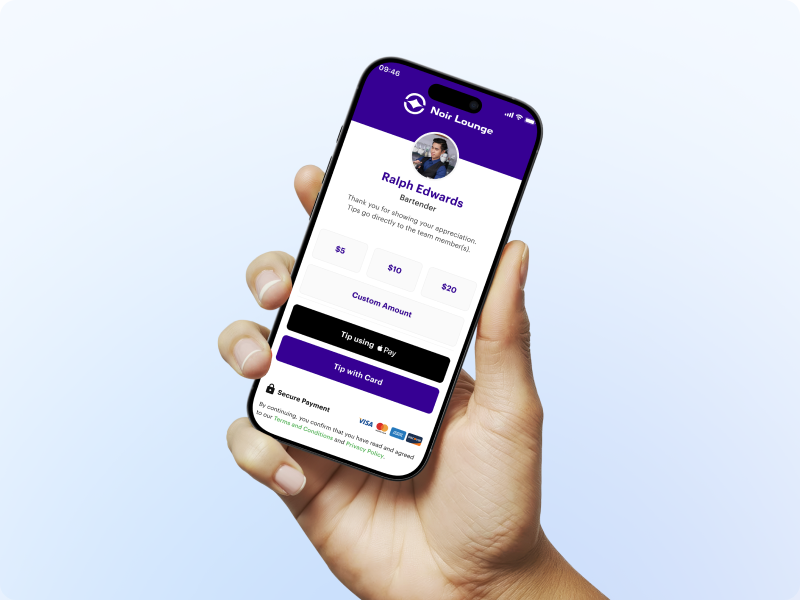

How a digital tipping solution simplifies tip credits

Managing tip credits on paper or spreadsheets is like trying to balance a tray of martinis in a crowded lobby — you might make it a few steps, but the odds of a spill are high.

Between tracking cash wages, reported tips, and shifting state rules, even well-run businesses can get tripped up.

But a digital tipping solution can help.

Instead of chasing envelopes and reconciling after the fact, every transaction is logged the moment it happens.

Digital tipping platforms provide:

- Real-time visibility: See exactly how much each employee has earned in tips, and confirm instantly that they’re above minimum wage.

- Custom allocation: Split tips by hours, shifts, or roles without confusing spreadsheets.

- Payroll integration: Payout tips directly through payroll, cutting out extra admin and ensuring IRS compliance.

- Audit-ready reporting: Export clean, accurate tip reports that stand up to scrutiny during tax season or a surprise audit.

eTip can help

eTip is the leading digital tip platform, trusted by major hospitality brands from Marriott to Hilton.

Our platform helps operators:

- Increase staff retention by up to 30%

- Boost tip frequency 5x

- Add up to $5/hour in staff income

More importantly, it takes the guesswork out of tip credits, IRS reporting, and payroll disbursements. Instead of juggling cash payouts and end-of-day spreadsheets, managers can focus on running their business — and staff can focus on delivering great service.

If you’re ready to simplify tip payouts, ensure compliance, and keep your team happy, schedule a demo of eTip!

Join the eTip community!

We'll send the latest content & special releases directly to your inbox.

Ready to join the community?

Receive the latest & greatest content from eTip, sent directly to your preferred inbox!